Tuesday, June 02, 2009

Credit market note: The return of high-yield bonds

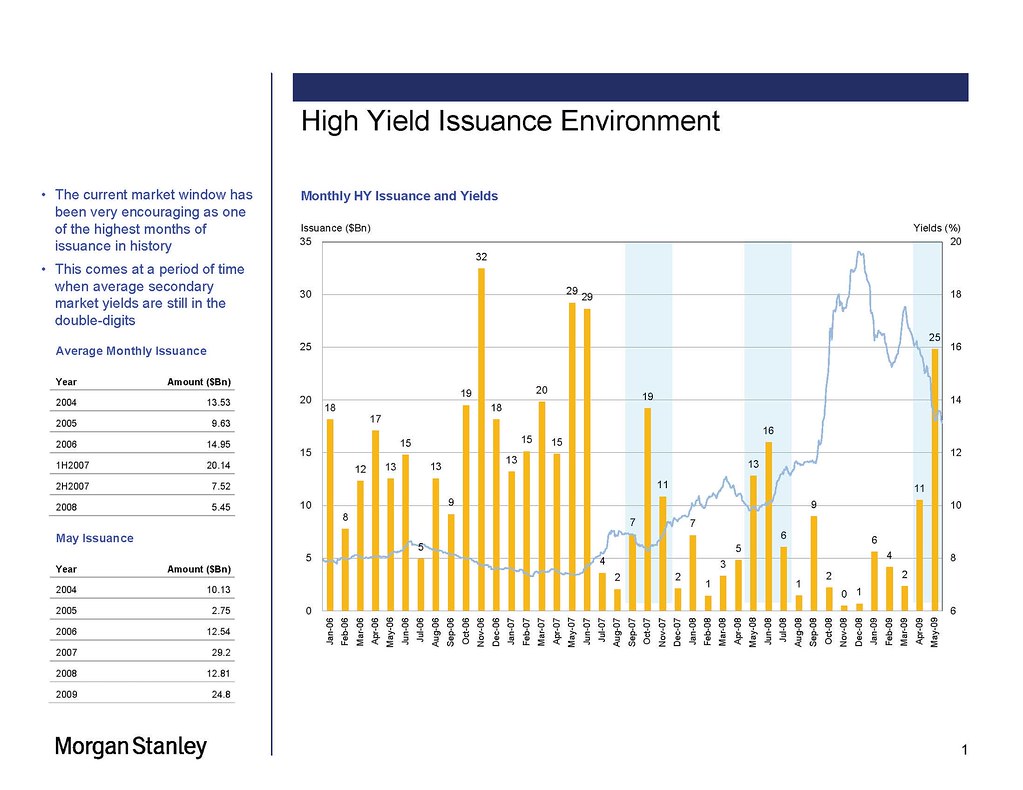

Morgan Stanley sent out a crisp email to clients last night that captures the massive improvement in the original issuance market for high-yield bonds. For those of you who are not financial professionals, high-yield bonds (originally "junk" bonds) are the debt securities of issuers that are below "investment grade." Since most companies are below investment grade (often for no other reason than they are too small or insufficiently seasoned to qualify for a high rating), the recovery of the high-yield market is a very important step toward the loosening of credit for American business. Anyway, herewith the email and accompanying graph.

The pace of improvement in the High Yield primary market has been truly amazing. Since the onset of the credit crunch, the primary market had effectively ground to a halt. In Late '07 and in the Spring of '08 there were two fairly robust market windows, but they were defined primarily as time periods where banks shed their hung LBO commitments. However, the current market tone is different. With the market tightening by almost 700bps since the end of 2008, High Yield placed $25Bn of new High Yield bonds in the month of May, which is on par with some of the highest monthly issuance rates in history (please see attached). So, the question on most issuers lips is "is this just a window that I need to sprint through, or is this the start of a broader recovery?"

High Yield spreads compensate investors for default risk and liquidity. However, most strategists think that spreads/yields at the end of 2008 were primarily driven by lack of liquidity despite the gloomy economic outlook. If default risk was the only variable, at the widest time in the market investors were being compensated for 70% of the market defaulting in the next 5 years with only a 20% recovery. Today, that same analysis means investors are being compensated for 50% cumulative defaults and 30% recovery. This is more realistic, but still probably includes very significant liquidity premiums. Given the economic outlook is still murky, the primary driver behind this improvement has been an influx of liquidity, as there has been a fantastic rotation into High Yield from other asset classes. In the beginning of this year, investors saw yields of 19% in High Yield index, which given the expected volatility in the equity market represented a pretty attractive relative value proposition, and cash flooded in. The majority of deals this year have been refinancings and there have been almost $10BN of net cash inflows into High Yield mutual funds since the start of this year. This has driven the over 20% returns High Yield investors have posted YTD, and has injected a significant amount of confidence into the market.

As a result of this significant liquidity infusion and strong sense of confidence today, it seems unlikely that the market goes back to the 4th quarter 2008 yields. The market is functioning fairly normally, but there is still concern that this market will shut again. We think that we will continue to see improvement throughout the year as the economy clears and liquidity continues to find its way back into High Yield. However, given the tremendous pace the market is experiencing right now, there are concerns of investor fatigue. Whether or not this turns out to be a market window or the beginning of a sustained recovery, the one undisputable fact is that the market is very accepting now to a wide variety of issuers and transactions at attractive rates.

When it comes to credit in the middle of a crunch, every little bit helps.

For background on the technical market issues that crushed the original issuance market back in late 2008 and into the first part of this year, see this December 28 episode of "TigerHawk TV," in which I explained essentially the same problem with reference to bank lending. If you have questions about the jargon in the email, post them in the comments. We have many learned readers who will delight in answering them, or I will when I have some time at the end of the day.

5 Comments:

By JPMcT, at Tue Jun 02, 06:52:00 AM:

The funny (not haha funny)thing about this is that the Fed has no earthy idea what is driving the yield curve...or what to do about it.

Sugar High? Chinese didling? Hello inflation?

I would not be too quick to say it is a good thing.

By , at Tue Jun 02, 08:57:00 AM:

For whatever this is worth a friend told me yesterday his company is reviving their dormant S-1 from last year. A return of IPO's would be a very, very welcome event. The economy may not be in good shape, but at least it isn't on it's deathbedany longer either. While, for us, the economy started downward last spring, business really fell completely out of bed for our businesss software company last October, when our customers really pulled in their horns and stopped apsnding completely. The subsequent downturn has been agonizingly difficult primarily because we have seen so little cause for optimism. That might be changing, right along with the financial markets and the industrial sector, as we have seen some few tentative orders. Let's hope for mo bettah!

By , at Tue Jun 02, 10:35:00 AM:

I'm not a finance guy, but how many jobs are being created that will produce non borrow and spend money??? Everything else seems like smoke and mirrors to me.

By , at Tue Jun 02, 09:08:00 PM:

"If you have questions about the jargon in the email, post them in the comments."

Perhaps now is a good time to ask for novice-level book recommendations on the subject, especially something geared towards terminology. I'd ask about specific terms in the article, but over the last few months I've been trying to get up to speed economic issues by teaching myself and it seems that whenever I come across a word/term/acronym I don't understand and try to look it up, via a Google search, I, more often than not, find a definition that includes a dozen new words/terms/acronyms I need to look up, each with their own unfamiliar terms in the description. So I'm sure I'd just be wasting your time with several other follow up questions. Any suggestions for decent books that allow a layman like me to get started understanding this stuff from the ground floor would be appreciated.

By Purple Avenger, at Wed Jun 03, 08:19:00 PM:

16% wouldn't be enough to entice me back. You can buy a solid dividend paying stock and write just out of the money covered calls every month and wind up doing about the same annualized return with a lot less risk of a wipeout.