Monday, June 01, 2009

The national debt in perspective

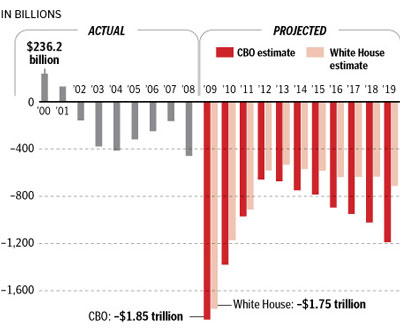

Everybody who has read a righty blog in the last couple of months has seen this graphic, which shows you what will happen to our federal government's annual deficit under various forecasts and according to its conventional calculation, which is designed to obscure what the future in fact holds.

The question is, how do these deficits and decisions already made translate into terms that the average person, or even the average TigerHawk reader, can put into perspective? Well, USA Today (of all papers) has done the hard work of putting together an interactive graph that calculates the average aggregate indebtedness for each American household, taking into account both the federal debt (including the burden of future obligations already committed) and household indebtedness. The calculation does not appear to include state or local government debt or business debt.

As calculated, the per-household aggregate federal and private debt came to a staggering $668,621.

Check it out. The problem, obviously, is Medicare and Social Security, which together account for $444,000 of the total, or around 2/3.

Daniel Indiviglio at the Atlantic Business Channel wonders whether we can pay it back. He runs some numbers on the annual debt service per household required to cover all of this over 30 and 50 years, and it is astonishing. Our democracy has quite simply voted itself more benefits than it can possibly pay form.

There is only one way out of this. Americans and their economy must produce more and save more, and American voters have to face reality and significantly reduce the long tail liabilities. You can argue around the edges, but that means we need pro-growth policies (we are heading the other way right now), we must tell healthy people that they will have to work longer before they can get our government's retirement subsidy, we ought to promote the immigration of educated and competent workers, especially those with capital (China and India seem like the best places from which to drain brains), and we have to find a way to extend lifespans without spending such a high percentage of GDP on healthcare. Above all, we have to get our political class under control.

Your better ideas are, of course, welcome, but I do not see how any solution will not require some combination of these policies.

CWCID: Glenn Reynolds.

21 Comments:

By , at Mon Jun 01, 08:24:00 AM:

What to do personally?

When I received a $250 "Economic Recovery Payment" I checked with Social Security. Two options: keep it or send it back as a "gift to the government."

I sent a check payable to the US Treasury to my Congresscritter. My note, using the platitude about holes and digging, returned my "little shovel."

I will not be complicit in this raid on my kids' labor.

By , at Mon Jun 01, 09:04:00 AM:

From Link:

USA Today uses fuzzy math -- but it illustrates the point -- this doesn't add up.

Long-term growth rates are critical -- If we grow at 3% or more, we should be able to cover Social Security. But even at 3%, Medicare is a back-breaker -- it's already a big reason why many states are going broke. USA Today leaves out that the burden of this government debt won't be evenly shared -- households aren't equal for tax purposes. Many Americans are convinced that it's not their problem -- someone else will pay for this, not them.

But there's not enough "working rich" making $200,000 to cover this -- so we'd need big tax increases on the middle class. But if we tax everyone with any savings, we'll never have growth. In fact, we're already killing any incentive to save or invest.

The difference in Obama's projections in this graph and Obama's is that Obama assumes just 0.5% more growth than the CBO. After a 2010 "sugar high" ... I doubt we even hit the CBO's lower assumed growth rate. None of Obama's "investments" will pay off -- many are actually anti-growth. Neither the CBO's nor Obama's "business plan" works. Thus, neither is financeable.

I suspect the Chinese mandarins see this too. Guenther was in Beijing yesterday to tell the Chinese that "no one is more concerned about future deficits than Obama & Co." I doubt this trip was planned for even a month ago. It seems that the Chinese are behind last week's steepening yield curve, as they've been significantly shortening the duration of their dollar holdings. Higher long-term rates will kill any recovery we may have going into 2010. Little Timmy is telling the Chinese that the US will cut deficits below 3% of GDP and soon ... but that's at odds with Obama's announced budget -- Obama has us running 12-13% this year. This is not a small disconnect: Is Timmy misleading the Chinese, or has Obama woken up to reality?.

Obama's budget plans will blow up ... it's just a question of when. I thought Obama would get to 2011 at least -- but the Chinese and others may be forcing a reckoning sooner. Understand that the Federal Reserve has started to literally print money by being the buyer of last resort for US federal debt -- this will increase dramatically -- we're in banana Republic territory.

The longer-term political cleavage won't be along traditional Democratic-Republican lines. It'll be between those who get government checks and those expected to pay for them. The former are much better organized politically -- Obama has built his coalition around them -- he's even co-opting the likes of GE CEO Jeff Immelt. The rest of us are terribly disorganized politically -- we should naturally go to the Republicans -- but they betrayed their small government roots. Angry white males aren't enough in number to build a coalition -- too many of them get government checks too. By necessity, the young need to be a key part of any winning contra-coalition. Will they ever turn on Obama?

Deloping ...

Link, over

By , at Mon Jun 01, 09:40:00 AM:

Every administration does the same thing ... and they selectively exclude line items to say "if you validate my plan for the next X decades, and the growth rate holds, and the interest rate holds, etc., then this will all work out fine".

There is only one solution: force those living on Lady Liberty's teet off of it. Cut the programs, and cut them now. Likewise, we need to address the unfunded pensions for otherwise highly comped public employees who draw a pension after fewer years of work than the average worker. Sure, the pay varies widely by state, but government from the municipalities up thru the Federal Gov't are bankrupt, and it's no longer sustainable. Time will not make it better.

We cannot afford the legacy costs of the millions who should be treated like the rest of us: save for your golden years, or get ready to hold up a signing that you'll "work for food".

I truly hope CA does cut it's welfare programs, and it kicks off a wave of migrating people state by state until all of them shut the programs down. We need tough love to fix this, not some message that we've just be dealt a bad hand and deserve a mulligan, big TV and a new generation of dependants.

By , at Mon Jun 01, 10:17:00 AM:

You miss the point! When the primary objective is the destruction of the middle class in America, Obama's administration is doing exactly the right things. Economics are not the objective, they are the means to this end.

When the inflation comes, most middle class wealth will be destroyed leaving most of us broke and dependent on the government and democratic criminal organization for survival.

And, the next attack will make this worse. Obama will demand, in response to that attack, imperial powers. The Congress, celebrating the new looting opportunities, will comply.

By Georg Felis, at Mon Jun 01, 10:59:00 AM:

Take a deep breath guys. First of all, it’s a chart from USA Today. Second, it lists “Mortgage” as one of the categories of debt, when *normal* mortgages are actually a small asset (Home Value – Mortgage = $$). Smaller now than it was a year or so ago, but still hopefully positive. Thirdly it treats (as addressed in TH comments) SS and Medicare the same as it does military and civil service retirements. SS/Medicare enrollment will jump as the pay-ers drop, but the active military/CS rolls should stay fairly constant (so pay-ers and pay-ees numbers should not shift so abruptly). Fourthly it labels the debt as by Household, instead of Per Individual.

Now for the bad news. If inflation gets going, while the GDP and employment drops, all those government obligations are *inflation adjusted*, which means our debt will skyrocket while our ability to pay that debt goes thru what I was taught as the Four Phases of Flight (Stall, Spin, Crash and Burn).

By Charlottesvillain, at Mon Jun 01, 12:00:00 PM:

If you look at the numbers and the political reality in the US, than you can see that a US default is inevitable. With the projected deficits it will become harder and harder to roll this debt over, and the austerity required to "pay it off" won't even be discussed as an option by politicans on either side. Getting the Americans to sacrifice in order to pay back the Chinese will become the new third rail of American politics.

As Americans we are extremely lucky that the debt is our own currency, something few other nations can say. We can simply print the money to pay it back, something the administration is in the process of doing. So the default will not be announced, but anyone holding US debt, or US dollars, will know that it has occurred.

Those who can should prepare for this eventuality. We are not going to grow our way out of this one.

By , at Mon Jun 01, 12:05:00 PM:

A whopping 52% of that tab is for Medicare! Yikes, what was Obama thinking passing such a massive spending bill that favored drug companies? Tsk. Tsk Certainly, George W. Bush would NEVER have signed off on such a fiscally unsound social program.

By , at Mon Jun 01, 12:12:00 PM:

To Anon 12:05pm

You're absolutely right about Bush and the prescription drug benefit -- he needed to buy the 2004 election, and the votes of seniors don't come cheap. The Republicans have no credibility on fiscal responsiblity either -- they're part of the two-headed beast that lives in Washington.

The closest historical model to Obama I can think of is Peron.

Link

By Dawnfire82, at Mon Jun 01, 12:18:00 PM:

A sarcastic reference to George Bush from 2004? Really? That's pathetic.

It's 2009. Bush is out. Your (presumably) guy won. Then he passed and signed off on what may be the worst new fiscal policy since the Khedive of Egypt. (who, incidentally, also ran up a gigantic foreign debt and defaulted, leading directly to the British occupation of Egypt)

Grow up and deal with it.

By , at Mon Jun 01, 12:58:00 PM:

I wonder if Lefties will ever come to terms with a plain fact that W was not really a Conservative president?

By , at Mon Jun 01, 01:19:00 PM:

Grow up and deal with it.

Thanks W, we'll be dealing with "it" for a long, long time.

By Purple Avenger, at Mon Jun 01, 02:00:00 PM:

Just drink the KookAid and STFU -- its all good....until it goes bad.

By , at Mon Jun 01, 02:05:00 PM:

While I agree inflation is the likeliest solution, it is by no means inevitable, and neither are confiscatory taxes. If the Obama administrations chooses to do so, the most serious extremes of our deficits could well be resolved by allowing drilling for oil in Alaska, in the Dakotas and off of our coastlines, coal mining encouraged and any other measures required to turn us into a net exporter of energy again. We have the worlds largest supplies of energy stored in the ground, and what's insane is that Russians are exploiting resources in Alaska we could be using and Chinese in the Florida Straits. In other words, it's not like the wells aren't being drilled, they are, it's just that we aren't getting the national benefit.

By MartyH, at Mon Jun 01, 03:57:00 PM:

With the push for alternate energy, we should be drilling today. Imagine that the President's vision for an America based on clean, renewable energy comes to fruition in twenty years, and the internal combustion engine is replaced by wind, solar, geothermal, dilithium crystals, cold fusion, whatever. While petroleum products are useful for many things, oil's main economic value is energy. The price of oil will plummet as demand does. America's energy reserves, worth perhaps trillions of dollars today, may be virtually worthless if President Obama fulfills this vision. It just makes sense to fill the gap before the oil era ends with American oil, not foreign. The jobs and the money will stay here.

It's like having expensive sushi grade tuna in your refrigerator and going out to dinner every night for a couple of weeks. The fish is going to be wasted if you don't eat it soon enough; America's energy reserves will be wasted if we do not consume more of them before we transition to alternate energy.

By Escort81, at Mon Jun 01, 04:14:00 PM:

I think that commenter mgoodfel over at the Atlantic site has a point:

This is not debt. The current external debt of the Federal government is just about $7 trillion dollars. Divided by a population of 300 million, this is $23,000 per person.

The number they are using is the present value of expected future obligations. In other words, what the government has promised to pay, not what it actually has borrowed. Even that assumes a continuation of the 6% plus growth in Medicare spending per year. Currently, they claim it's $11,000 dollars per year per person. At 6% growth for 30 years, that would be $63,000 per year per person for Medicare alone.

We have to stop that growth in medical costs per person. If you do that, the picture looks very different.

In any case, please don't call this debt. It's just promises, and promises can (and will) be broken.Now maybe this is a terminology issue, or a distinction without a difference, but (as a very rough analogy) the debt on the right hand side of a GAAP balance sheet isn't quite the same thing as off-balance sheet financing or other commitments and contingencies listed in the notes to the financial statements.

Also, I think that mgoodfel would agree that the $7 T number is about to double, if the infamous downward pointing bar graph pictured above is even close to accurate.

I would also say, with respect to mgoodfel's point, that there is almost no way to stop the growth in medical costs per person under the current way that the health care delivery system and health insurance system works. When Boomers are in their 70s and 80s, that number will do nothing but go up.

Inflation is the most likely way out, so the question becomes what asset class (other than ammo!) to hold as the best hedge against likely double digit or sustained high single digit inflation over the course of a decade or more. (In 7 years, given 9% inflation per year, the value of cash is about cut in half.)

If we get the hyperinflation that is being discussed in certain small circles (and I am skeptical), then ammo really is the way to go.

In the immortal words of Bluto, "My advice to you is to start drinking heavily."

By , at Mon Jun 01, 06:34:00 PM:

Thanks W, we'll be dealing with "it" for a long, long time.Why are we just blaming Bush for this? If the Democrats had any real objection to it they could have voted against it when it was first proposed, and given their current Congressional majority they can squash it now if they wanted to. They didn't, and they won't, blaming Bush is a means of deflecting blame away from themselves.

By JPMcT, at Mon Jun 01, 06:57:00 PM:

I can't get over all the SURPRISE that the Federal Government is unable to manage healthcare, fund retirement, bail out businesses and deal with energy policy!!

Did we all forget that the Constitution did not empower the Government to do ANY of those things?

Are we surprised that a group of beaurocrats who can't deliver the mail or run the trains on time could POSSIBLY have issues with such complexities?

The simple answer is the FREE MARKET. We currently elect people who restrict the Free Market's ability to offer competetive solutions to health care, retirement funding, banking regulation and energy production.

For God's sake, voters need to insist that government get BACK into the business of defense, regulation of interstate commerce and border security and leave the rest to the experts...the intuition and genius of American entrepreneurs.

Otherwise, my friends, we are simply doomed! The State CANNOT do these things. History has proven this again and again and again.

Too bad we dont teach kids History and Civics anymore......

By , at Mon Jun 01, 08:49:00 PM:

Related to all this hope and change, spending like it's OPM ... check out Mish's blog for the Chinese reaction to Timmy's pathetic showing.

We're boned unless we reign in all this wasteful spending and freebies. Everyone should be paying their fair share so that we're each incented to hold our politicians in check. No one values what they don't pay for ...

By Aegon01, at Mon Jun 01, 09:32:00 PM:

JPMcT:

Totally agree. Obviously it's not JUST the government, though.

The problem has just been greed, because that's what all of society is based on. Drugs are overpriced and healthcare is expensive because of greed. Politicians deceive and manipulate to get elected for power and money. People borrowed money recklessly and stretched their income to it's farthest stretches for the purchasing of useless crap they don't need. The frustrating thing is that I know that I'm no different either.

I suffer from an Upgrade Monkey on my back, which is constantly telling me to get a slightly better version of something I already have for thousands of dollars more. I know that if I had a credit card, I'd be up to my ears in debt already. It's because our culture encourages the idea that there might be free lunch, or at least lunch that you don't have to pay for NOW.

Don't get me wrong, I know that since the Free Market harnesses the incredible power of our self-interest, it's clearly the best system for humankind, at least when we're at this level of development. But we've got to control ourselves. Think how greedy aristocrats 100 years ago would think we are.

But who knows? Maybe the Chinese will outsource work to US!

By , at Tue Jun 02, 01:02:00 AM:

Hey TH, that's one sharp kid you have there!

He is dead-on accurate about the greed issue and our culture.

How the hell did we let things get away from us...?

By JPMcT, at Tue Jun 02, 07:34:00 PM:

@ THteen

Quite true...but greed, like beauty, is in the eye of the beholder.

Drug companies spend millions on R&D to produce a few wonder drugs. They need to make a profit for their employees and stockholders (that would be you and I).

You want cheap drugs? Get generic. Go to Walmart. Apply to the drug manufacturer for membership in a charity program.

Healthcare quality is superb. You want it cheap? Go to a teaching hospital. Go to an ER. Negotiate with your doctor.

My point here is that the vast majority of GOOD things are inexpensive and available under the Free Market System. BECAUSE they are market driven.

The Cadillacs, Opus Ones, Plastic Surgery, Viagra, JewelBox houses and Sushi grade Tuna will cost you, because "those" consumers can afford it.

Our problem is that we call it "capitalistic greed" when a guy making 30 grand a year can't live in a mansion.

It all comes down to maturity and reality testing.

Give me a Greedy Free Market over a Federal Program ANYDAY!!!