Tuesday, April 07, 2009

One reason lending has not resumed

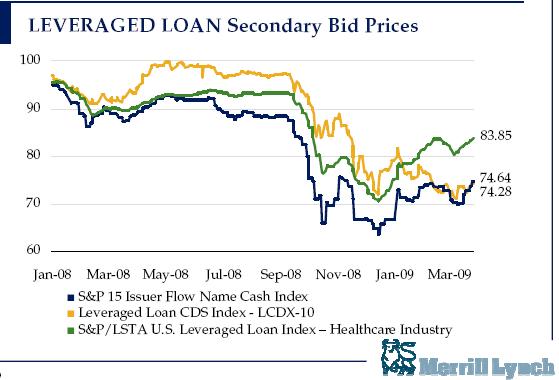

From time to time I have observed that money-center banks, whether or not they are TARP-recipients, will not resume making new loans until prices in the secondary loan market -- meaning the trading prices for bank loans that have already been made -- have recovered to some significant degree. Why? Because as long as it is possible for banks to earn a high return by buying a performing secondary loan they will not incur the cost and risk of making a new loan to a new borrower. Fortunately, the prices of secondary loans are recovering (as they have been, in zigs and zags, since December), so there is finally some prospect of the primary market opening up for some borrowers at some reasonable price.

Now, to be clear, the pricing of these older loans will never return to their high pre-crisis levels because market rates have gone up significantly. Loans of even solid credits entered into at pre-crisis pricing will have to trade for significantly less than par even when the secondary market entirely normalizes in order for the buyers of those loans to earn the new higher prevailing interest rates.

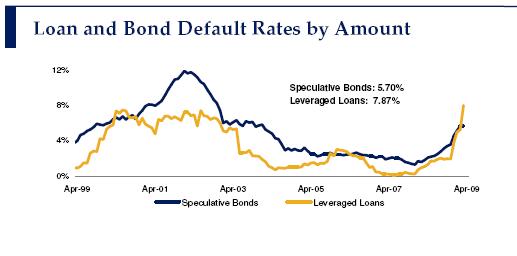

So, why have interest rates for these loans gone up when rates for Treasury securities and other guaranteed obligations are so low? Two reasons. First, so much lending capacity has been destroyed by losses that there is a lot less competition among those banks and other lenders which still have the capacity to make loans. Less competition makes for higher pricing.* Second, default rates in the leveraged loan market are rising, which means that banks need higher returns to compensate for the greater risk of future default.

Of course, among our readers there are people who know far more about this subject than I do, and their comments, elaborations, and corrections are more than welcome.

______________________________________

*Occasionally you will hear somebody wonder how it was that the antitrust laws failed to prevent the big financial institutions from getting too big. The answer (for you non-lawyers) is this: Our anti-trust laws, for better or for worse, are designed to foster competition. At bottom, the credit bubble was at one level caused by competition -- too much of it, in fact -- in the making of loans. Laws designed to promote competition are not useful when the problem is too much competition.

5 Comments:

By , at Tue Apr 07, 02:50:00 PM:

I’m a treasury guy with an E&P. Based on what I’ve experienced and hearsay from my buddies:

--Ancillary business is the key. Banks are not at all bashful about asking for treasury mgmt business, deposits, hedging business, cap markets business, advisory business, etc. There used to be “shut up and fund” banks who were just happy to be in the facility for $10MM, but now everyone wants a piece. Interestingly, bank loans are still a “loss leader.”

--Having said that, though, the price grid has been going up over the past 18 months or so.

--If you have a relationship with a bank, you can usually keep your bank line more or less where it is (subject to…). Banks do not seem to be cutting back exposure. New money? Not so much.

--Among E&P’s I follow, there has been a lot of talk of asset sales in the wake of the semi-annual “borrowing base” season. I have not seen much of this, as most E&P’s I follow hedged pretty well…but due to the way Credit Agreements are typically written, it’s difficult, especially for offshore or Gulf Coast names to hedge much beyond 2-3 years. As the hedges burn off, if prices stay low, the Sept-Oct 09 BB season will be ugly. An interesting exercise would be to pull from Bloomberg the senior debt for companies with SIC 1311 and compare to credit ratings. Might be an opportunity there.

--Regional banks have started to ask for LIBOR floors, the larger banks, not so much. Not sure why..something related to funding? Previously, this was only common in 2nd lien facilities, which are yield products, not spread products.

--I have not heard any inkling of this yet, but the other shoe I fear is that foreign banks will be forced to cut back lending to the USA in preference for lending locally. Politically, how can the French or UK taxpayers bail out a bank then see the cash go overseas? It will be interesting to see if this affects relative performance of EU vs US stocks or if “debt protectionism” catches on over here if it’s done over there.

--Tenor of bank loans among non-investment grade credits are 3 years instead of 4-5 years.

By , at Tue Apr 07, 02:52:00 PM:

#1 here. They not only want cap markets business, everyone wants "left books."

By TigerHawk, at Tue Apr 07, 03:02:00 PM:

All good points, Anon, and within my experience as well. Interesting comment about "debt protectionism," which I had not thought of.

By , at Tue Apr 07, 03:03:00 PM:

#1 and #2 here. Another observation: To the extent banks are paring back exposure to a name, it's ironically the healthy ones who are most likely to get a trim. You can't ask for liquidity "because you want it...because you want dry poweder." It's interesting that the guys who are running close to the wall are more likely to get love 9for a higher grid). I think the banks are just afraid of forcing guys into bankruptcy and becoming the owners of O&G assets that aren't worth much.

Of course, some of my banker friends have been laid off and rehired into the workout group. If you have capital and an experienced management team, this oculd be the chance to make some money.

By Robert Arvanitis, at Tue Apr 07, 04:42:00 PM:

Tigerhawk notes that lending rates have risen, in terms of spreads over Treasuries.

The spreads are indeed wider, partly from reduced competition, and partly from the need to cover losses given default.

But a big piece of the spread goes to the liquidity premium, the charge for uncertainty in tradable assets and the capital needed to "make markets." And what is the greatest uncertainty of all? The unpredictability of prospective government interventions and rules changes.

This spills over into assets in the "held to maturity" category. At some point, everything trades, even if it's an artificial "mark." So everyone needs that extra, wasteful, uncertainty margin.

Thus government's own hand creates a wasteful deadweight cost.