Tuesday, September 16, 2008

The Fed just bought AIG

The Federal Reserve Bank of the United States just bought a huge stake in American International Group. Like Megan McArdle, I am speechless. Not saying it is the wrong move, just that it describes more graphically than any statistic the massive liquidity squeeze that is crushing the credit markets.

But I do have statistics.

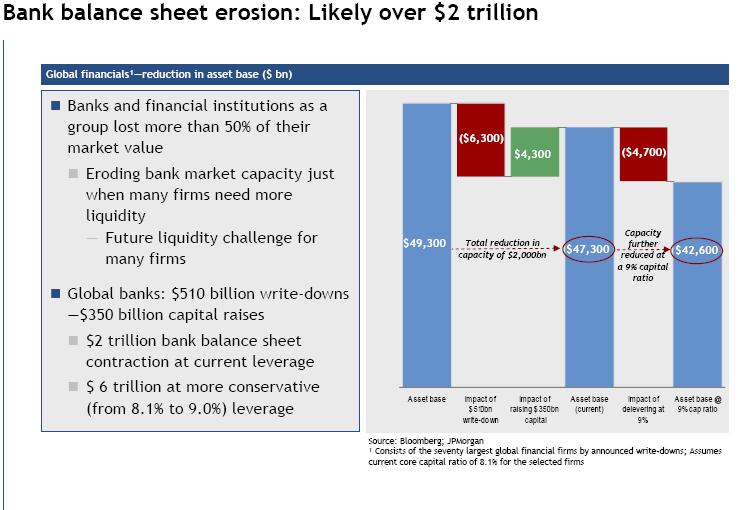

Yesterday I sat in on a conference call hosted by the debt capital markets group of one of the stronger banks in the world. It was chock full of scary news, and included the slide below. Essentially, it shows that the estimated aggregate write-offs to hit the world's banks has exceeded new equity investments in those banks by $160 billion.

Doesn't sound so bad on a business with $50 trillion in assets, does it? But equity destruction in banking has a much greater impact on lending. Since each dollar of equity can support $11 to $12 in lending, the net reduction in global equity has resulted in aggregate bank lending capacity contracting by $2 trillion. That is a huge reduction of lending capacity in a short period of time. The real economy will notice.

10 Comments:

By Deuce ☂, at Wed Sep 17, 12:10:00 AM:

With a $2-trillion write down, increased interests rates and a dramatic reduction in lending, the world is clearly heading into a deflationary period. The deflation in real estate and commodities has begun however governmental spending worldwide has not declined.

In a sense, the Keynesian solution is already part of the financial structure of most Western nations. Excuse me for sounding Panglossian, but maybe this will not be as bad as we think likely.

By davod, at Wed Sep 17, 01:18:00 AM:

when will the government buying spree stop.

Obama is a Marxist, but I am having difficulty distinguishing what he would do with what the President is doing.

All we need now is for the president to announce that he was federalizing all volunteer orgainizations and Obama would be trumped.

By apex, at Wed Sep 17, 01:25:00 AM:

Actually, to me this looks like a shrewd move. AIGs biggest problem was the loss of its rating,which would have increased their refinance costs compared to the competition. The Fed moving in keeps their refinancing costs constant, and thus keeps the business viable, while the cash infusion also stabilizes the balance sheet. I'd be greatly surprised if the Fed isn't able to sell of its AIG shares in a few years, and at a significant profit. I wouldn't see this as a bailout, but a great deal.

apex

By JPMcT, at Wed Sep 17, 07:10:00 AM:

Endless Federal tinkering in this big bubble burst should be feared. It turned an adjustment into a depression in the 1920's and there is no reason to suspect it will not ultimately do the same now. The huge buyouts cloud the true price/value of the entities and will certainly delay their reacquisition. The end effect is to prolong the recovery. At least the FEd did the right thing.

By , at Wed Sep 17, 08:20:00 AM:

Question: Perhaps Mindle S. Dreck knows part of the answer.

Is the presence of so many derivatives and that sort of paper a large part of what is happening now?

Meaning, the derivatives were part of the risk-minimization for making higher risk loans (of all sorts, not just home loans). Is the problem now the collapse of many of the derivatives and their "face value"?

-David

By , at Wed Sep 17, 09:56:00 AM:

The problem is that the financial types have separated risk from reward and maximized their own personal rewards. It started with lending mortgage money to folks who couldn;t otherwise qualify and bundling the paper to sell to others. If effect, they took one dollar bills and sold them as fifties. Then, one day, some one said, "Hey, this isn't a fifty!"

This jackpot bonus has tried to seep over to every other industry. But, it exists especially in financials. Next year, when AIG goes belly up for sure, we'll find that a lot of the 85 billion went to pay bonuses and, they'll maintain that the bonuses were necessary to remain competitive in attracting and retaining key employees. BULL***T!

Next come the US auto makers. Much of their bail out money will go to unions to continue to fund Obama and the UAW.

Hey, Mr. Poulson. The lottery ticket I bought for Saturday night turned out to be a total loss. Where do I go to get my $10 bailout?

By Dawnfire82, at Wed Sep 17, 01:39:00 PM:

Heh. You folks may as well be discussing the finer points of Zoroastrian sorcery as far as I'm concerned.

Being reminded from time to time that you're not a universal know-it-all is a good thing, I think. It helps to keep you humble.

By Gordon Smith, at Wed Sep 17, 02:02:00 PM:

Privatize the profits and socialize the losses.

What a stunning economic policy.

By JPMcT, at Wed Sep 17, 03:04:00 PM:

"Privatize the profits and socialize the losses"

The government got it's cut through confiscatory tax rates and now it owns the defaulted companies for pennies on the dollar...all the while ignoring the need to regulate the industry.

Going all the way back to Clinton's choice of Cuomo, this is a lab exercise in fiduciary incompetence at best and malfeasance at worst.

If most of the public weren't too dumb to know what's going on, there would be a citizen's storm on the Capitol. As it is, Obama will blame McCain, McCain will blame Washington and the victim's (ie. the Electorate) will vote for the guy with the best campaign video and probably elect another in a string of economicallly incompetent leaders.

Yeah...that will fix everything.

By j willie, at Wed Sep 17, 05:54:00 PM:

That is a huge reduction of lending capacity in a short period of time. The real economy will notice.

Not necessarily. One of the sources of the subprime mess was EXCESS liquidity. Eliminating 4% of the total liquidity is probably not nearly enough.

That chart was probably produced by bankers for bankers and is therefore banker-centric in its focus.

Furthermore, you have to look at the distribution of the equity losses - heavily concentrated in money center banks lending to other financial institutions (hedge funds, investment banks, etc.) The vast majority of 8500 banks across the US make loans against local real estate and the cash flow and/or assets or real businesses. Consequently, the impact on main street should remain negligible.