Monday, June 16, 2008

Old school accounting

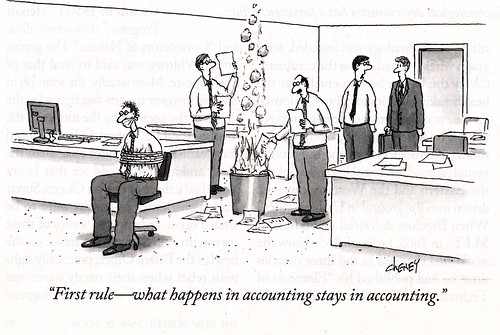

I've been pile-driving online continuing legal education, twenty hours of which I have to endure by the end of June if I want to hang on to my Illinois license. Much of this evening has been given over to a long seminar on the management of the legal and accounting issues around "options backdating." So, I'm abstent-mindedly leafing through the giant pile of magazines on my desk while I listen, and I come across this cartoon...

6 Comments:

By , at Mon Jun 16, 11:49:00 PM:

Yea, I saw something like that on an audit one year. Needless to say, that was a fun experience.

By , at Tue Jun 17, 12:13:00 AM:

Tige, I think of you as one who holds Sarbanes Oxley in minimum high regarrd. Fair enough, but this cartoon might be a good jumping off point for you to discuss what you would do to get control of these criminals. Or is it the teaching of old-school Republicanism that we are all just so screwed?

By TigerHawk, at Tue Jun 17, 06:43:00 AM:

Anon 12:13 -

A short-hand response.

1. The pre SarBox securities laws were entirely adequate to send the "Enron era" bad guys up the river.

2. In addition, it is not obvious to me that criminalization is necessary. Private lawsuits, with their lower burden of proof, are more than adequate to move corporate executives from one socio-economic class to another, which is also pretty a pretty big deterrant from their point of view.

3. Sometimes deterrants do not work and people commit crimes. Then they are prosecuted. So what?

4. Many of the reforms embedded in SarBox were simple to implement and made great sense. No loans from public companies to executives (why should a company act as a bank), no executive stock sales when the employees cannot sell, beefed up rules for independence on the board and audit committee, and so forth.

5. Other aspects of SarBox, though, are extremely difficult to implement, exist primarily to *prevent* fraud ex ante rather than deter it, will no doubt be inadequate to that, and both (i) change the attitude of a business toward risk and (ii) put American companies at a great disadvantage to foreign companies. Some fairly credible people argue that they also put our securities markets at a disadvantage.

SarBox will stop petty fraud among low-level employees, because they can no longer do anything on their own initiative and without multiple sign-offs. Why was petty fraud an important social problem to fix? Businesses had already made the judgment that they were prefer a certain level of fraud to the bureaucratic costs (both in money and culture) to prevent the fraud ex ante. It is difficult to see how the SarBox process-oriented laws would have stopped most of the really big problems that surfaced at the end of the Clinton boom.

By , at Tue Jun 17, 07:18:00 AM:

TH:

I'd add that I am an accountant ... about your age. I've seen public and private businesses from the other side, and can assure you that "audit opinions" have always been (from my perspective) and opinion for a dollar. The system is set up for people without scope, knowledge or frame of reference to collect data and summarize it cookbook style for layer after layer to massage and roll up the chain. The partner makes money by producing audit fees, not by losing the client. In more than one instance, I TOLD the audit manager where to look, with a wink and a nudge, refused to sign the rep letter, etc. and we still got the "clean opinion". A very good friend from my undergrad years was in the room at Enron with AA. They discussed the fraud, they knew all about the risk, and they took it anyway. Tossing them in prison, after disgorging them of all their trappings is the course of action. But the Gov't didn't go far enough ... they need to take the auditors also to create the proper "tension".

Instead, the failings of the audit world just got them replacement work for their "consulting" sides ... SarBox work.

JT

By TigerHawk, at Tue Jun 17, 07:29:00 AM:

JT, I suppose I directionally agree with your point, although I have noticed a real change in how Big Four firms treat their clients in the last six years; I think you are getting much of what you want in the post-Enron climate, and some of it is good (and some of it is overboard).

That said, the Arthur Anderson prosecution was really dumb. The AA partners went to the other firms, and apart from some financial loss they are back in business, only with less price competition.

By , at Tue Jun 17, 03:24:00 PM:

2. ...Private lawsuits, with their lower burden of proof, are more than adequate ...

4. Many of the reforms embedded in SarBox were simple to implement and made great sense. ...

TIGERHAWK EMBRACES LENINISM! FILM AT 11!