Wednesday, September 23, 2009

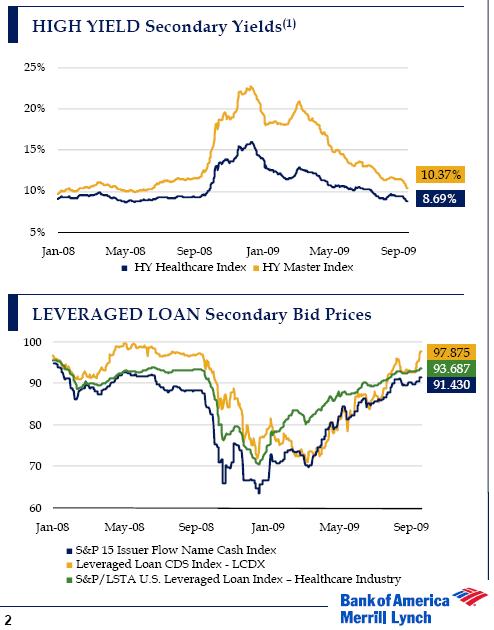

A graphical look at the recovering credit markets

A year after the world's credit markets went to hell in a handbasket, by certain measures they have recovered (even if there is no longer such savage competition among lenders that any fool with a dream can borrow money). See, for instance, the following two graphs, which show that yields (interest rates) on "high yield" (meaning below investment-grade or "junk") bonds have returned to year-ago levels or below, and that prices for leveraged loans in the secondary market have returned almost all the way to par. This is good news, because it means that lenders can no longer earn above-average returns by buying existing credits instead of making new loans. And, sure enough, bankers -- both commercial and investment -- are again making the rounds of reasonably creditworthy companies proposing new financings.

1 Comments:

By , at Wed Sep 23, 12:08:00 PM:

Obama is planning new taxes on an inhuman scale. That'll put us into a depression. He's got the absolutely worst foreign policy in the history of the country, which will lead us into a global war soon enough.

Other than those items, the less bad news from the credit markets is certainly encouraging.

Now, if only the government would hand out free Prozac it wouldn't all seem so depressing...