Sunday, January 15, 2012

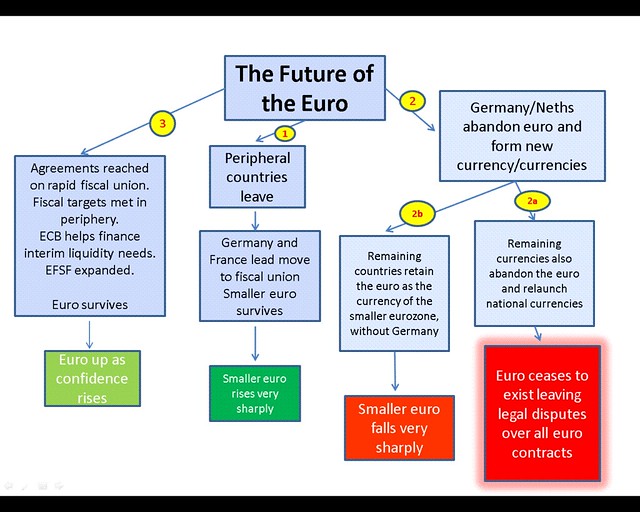

Charting the future of the Euro

3 Comments:

By , at Mon Jan 16, 09:50:00 AM:

I don't know that any of the scenarios above are realistic. I don't know how you can take the Euro apart without a lot of breakage.

e.g., Can the Euro just disappear and all that happens is a lot of litigation?

There's too much collective debt in Europe. Money is a kind of debt, and the financial system has created several kinds of multipliers.

How do you allocate debt among nations in a break-up? Even if you try, some of the players can't afford any kind of "fair" allocation. The Germans can't pay for it all, even if they agreed to.

Which means many European banks are already broke, if there was a true mark to market. Many other are broke on a second order mark because of their derivative exposure to nations and the first-order banks. How does this contagion not hit some big US banks?

Any of the above scenarios will trigger this.

So it's all just Extend and Pretend. It works so long as the music plays and money keeps flowing. Hence the Fed recently swapping dollars for Euros.

Europe's problems have been helping the US so far by propping up the dollar -- we're a good credit, comparatively.

So Obama & Co can spend an extra trillion each year.

This can't last. What then?

By E Hines, at Tue Jan 17, 09:58:00 AM:

I'm trying to follow your logic. Bad things happen when any house of cards falls. How does that prevent the collapse?

It'd be ugly all over the world were the euro zone to break up, or the euro to disappear altogether. What's actually going to prop up this house of cards? Where's the glue?

Eric Hines

By Georg Felis, at Tue Jan 17, 06:19:00 PM:

Need another column: Euro explodes in flames, hyperinflates to a vanishing point, Europeans introduce another currency the "This-Is-Not-A-Euro-Honest-Really" coin backed up by the gold inside a cubic foot of seawater. US stock market makes a recovery from all the money fleeing the disaster. George Soros makes a Septegillion Dollars and 39 cents out of the deal.