Tuesday, November 15, 2011

A short note on housing bubble ideology

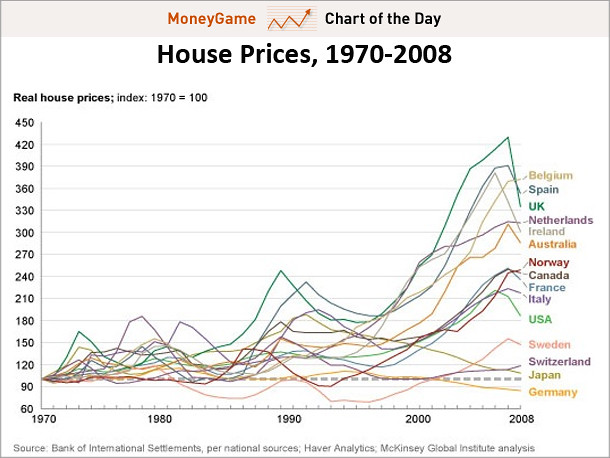

A nifty Chart of the Day on the housing bubble worth digesting by both left and right:

The linked post makes the point,

If you really think it was all Fannie and Freddie's fault, then you have to explain why the U.S. just happened to have the same (roughly) arc of a housing boom as basically every other industrialized country all around the world at the same time.

True dat, and the same goes for conservatives who put it all on federal mandates for more minority lending. But the chart also discredits lefties and populists who blame the crisis on the compensation systems in American banks or on the degradation of lending standards on account of credit securitization or on the repeal of Glass-Steagall.

There were many reckless lenders and borrowers over the last decade, all over the world. The original and most basic reason is that there was too much competition in lending, which pushed banks and other financial institutions to offer ridiculous terms to irresponsible or incompetent borrowers. Those lenders competed so aggressively because they had too much capital on their balance sheets, money that for all intents and purposes had to be lent (or the stockholders would essentially fire the bankers in question for losing money). Those huge balance sheets were the consequence of too much credit created or suffered to exist by the world's central banks, including but not exclusively the Federal Reserve Bank of the United States. Why did the Fed and other banks allow credit creation in excess of GDP for so many years in a row? Partly because nobody wants to stop a bull market before its time -- there is more or less no better way to piss people off -- but also because the usual signal for too much credit -- consumer products price inflation -- was masked by the one-time migration of the world's production to China. Tons of credit, soaring asset prices, and tame inflation. What's not too like?

Oops.

10 Comments:

By Portfolio Manager, at Tue Nov 15, 09:53:00 PM:

It is the story of inflation everywhere and in every time: too much money chasing too few goods.

By , at Tue Nov 15, 10:26:00 PM:

Yes Tigerhawk, but a lot of the big banks were all following the same practices, expecting Real Estate to appreciate forever, then turning their mortgage holdings into investment instruments, then creating CDO's and CDS's to hedge their bets - more creative credit creation.

I am not a scholar of the financial system, but it would be interesting to know who "invented" all these credit devices. I would merely speculate that the reason these credit "devices" were created was to create fiat "wealth" in the face of the onerous Welfare State and taxation (everywhere in the G20 countries), and to offset the loss of creation of real wealth by manufacturing that has, in some degree, moved to the developing countries of Asia and out of the G20 countries.

Fannie and Freddie in the US were tools used by the apparatchniks of the government to create the visible hand that was beneficient, to get votes. There were other, similar practices under different guises in Europe too. The EU mandated transfer of capital from the wealthy North of Europe to the more impoverished South of Europe, and this was another avenue for political graft. The company that I formerly worked for was involved with that, but of course for the most honest reasons. Uh-huh.

By , at Wed Nov 16, 09:44:00 AM:

"If you really think it was all Fannie and Freddie's fault, then you have to explain why the U.S. just happened to have the same (roughly) arc of a housing boom as basically every other industrialized country all around the world at the same time."

The short answer to that statement is threefold: First, the arcs aren't all that similar--witness the real money nations of German and Switzerland and deflating Japan. And second, the mere fact that there was a global credit boom does not excuse the two FMs from their culpability for failing to regulate risk in the mortgage market. Third, it was collapse in the US credit markets that triggered the global credit contraction which took down housing prices in other countries--note from the chart how the peak in the US precedes the peak in other countries in time.

Did global credit issuance and the massive growth in the shadow banking system drive up real estate asset prices? Yes. Did other countries have real estate bubbles? Yes. Do either of these facts absolve the two FMs for failing massively to execute their job as risk managers? No.

--Anon Attorney

By Kurt, at Wed Nov 16, 12:31:00 PM:

Those are all excellent points, Anon Attorney. I also noticed that about Germany, Switzerland and Japan. In the case of Japan, the deflation was a consequence of the boom there in the late 80s and early-to-mid 90s.

Sweden is also an interesting case because it looks like the housing market there was depressed for much of the 90s.

By , at Wed Nov 16, 12:38:00 PM:

I second Anon Atty.

This graph is informative, but it's noisy. e.g., Ireland's population isn't much bigger than Brooklyn's and had a different dynamic than most of the rest of Europe. e.g., I'd expect that if you broke out California or the other Sand States in the graph they'd top the chart. Some US states would look more like Switzerland. Lastly, how you pick your "100" baseline can affect the optics of your result.

Fannie/Freddie have been distorting our residential real estate market for decades. It increased significantly over the last 15 years. The irony is that Fannie wasn't created back in the 1930s to promote home ownership, but was instead created to give small banks liquidity so they could make commercial loans. The Mom and Apple Pie home ownership meme came later, once Fannie was quasi-privatized to help pay for LBJ's Vietnam War. It's an example of how well-intentioned federal efforts can often morph into something very different over time. An engineer would say that it's because the feds often create crazy-ass reinforcing feedback loops without any "governing" offset -- so they redline, financially.

By W.LindsayWheeler, at Thu Nov 17, 09:05:00 AM:

Well, this party is over.

Estimates on the amount of derivatives out there worldwide vary. An oft-heard estimate is $600 trillion. That squares with Mobius' guess of 10 times the world's annual GDP. "Are the derivatives regulated?" asks Mobius. "No. Are you still getting growth in derivatives? Yes."

Did you read that---"""600""" TRILLION! I thought it was 60 Trillion in CDOs. No it is 600 Trillion! It's not over by a long shot. Banks in England have no money to lend to businesses!

From Hellish Financial Crisis coming

By , at Thu Nov 17, 09:13:00 AM:

It has been said that Rockefeller knew a crash was coming in '29 when he was asked about stock picks by an elevator operator. I knew we were in for huge trouble when I notice signs, in Spanish, offering homes for sale without proof of income, without proof of citizenship. Why no one in the government saw the same signs we will never know. We will just get stuck with the bill. For the rest of our lives.

By buck smith, at Thu Nov 17, 09:41:00 AM:

@tyree I figure we can be out of this in 4 years with policies that support free enterprise and if the government raises money selling assets and leasing mineral production right especially oil and gas.

By , at Thu Nov 17, 06:01:00 PM:

Largest population boom in world history following WWII bought as many houses as they wanted, then stopped.

By , at Fri Nov 18, 06:29:00 PM:

The chart measures housing costs - not risky loans. Making it possible for high-risk borrowers to enter the market would have made prices go down, right? What's the connection?