Friday, June 04, 2010

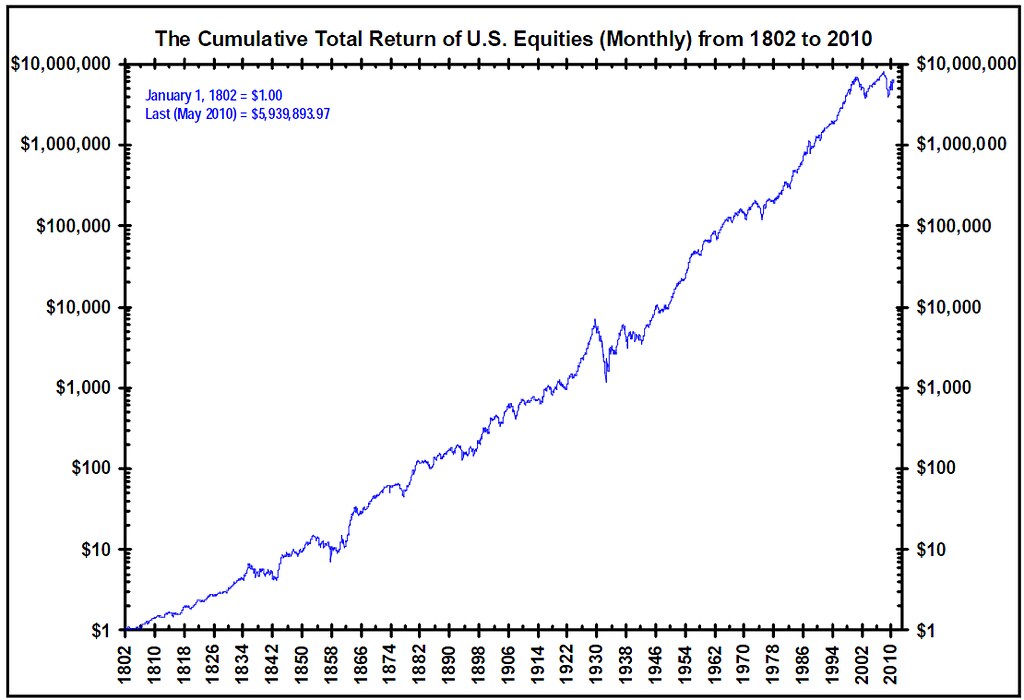

Chart of the day: Equities for the long haul

When investing, play the long game:

I suspect that the current bear market, which really goes back to 2000-2001, will end up having been a buying opportunity. Unless, of course, you only have a few years yet to live.

11 Comments:

By Neil Sinhababu, at Fri Jun 04, 04:27:00 PM:

It's a little hard for me to figure out how to read the chart. Gains seem to have accelerated somewhat in the postwar era, and a reversion to the 1802-1946 historical trendline could involve a couple decades of stagnation.

I guess if you were really into technical analysis, you might see a head & shoulders pattern starting to develop at the top. It's a long way down! But I don't know how much to trust that TA stuff, especially on long-term stock movements.

Of course, I'm a young fellow with few expenses other than dinners with girls and whiskey for when I find out they're not interested, so I need to put my money somewhere. Lately it's been mid-cap ETFs, as they have low fees and mid-caps have historically outperformed. Plus, you sometimes make money off of an S&P addition.

By Georg Felis, at Fri Jun 04, 05:42:00 PM:

Adjust for inflation please, or its worthless.

By , at Fri Jun 04, 05:47:00 PM:

Buy and Hold has traditionally been the mantra of the investment (selling) community. Success, however, depends on when you buy and how long you are able to hold. Many retirement programs are in deep trouble, and people will need that money before we see enough growth to generate it.

Anti-growth, anti-capitalist, and anti-energy policies linked with huge additional entitlements (healthcare) won't get us there.

By JimVAT, at Fri Jun 04, 07:59:00 PM:

So, who was alive in 1810 that it is alive now? I was born in 1969 and started my professional career in 1991. 1991 to now is my relevant time horizon, not that bogus chart.

By , at Fri Jun 04, 08:00:00 PM:

Anon Attorney here.

Agree with Georgfelis. Adjusted for inflation, the S&P 500 has provided a big, fat zero return since 1995, and damn close to zero since 1965. I believe the S&P needs to drop to about 800 to erase all returns since 1965. I suspect this will happen in 2010 or 2011. Here's a link to an inflation-adjusted S&P 500 return chart.

http://www.simplestockinvesting.com/SP500-historical-real-total-returns.htm

It's a sad reflection on corporate America.

By Bomber Girl, at Fri Jun 04, 08:54:00 PM:

Anon attorney, two comments: 1) good charts as reminder of how much dividends have mattered historically. 2) why not make your moniker "anon attorney" officially. just sayin'.

By , at Fri Jun 04, 09:09:00 PM:

A chart which has the same scale for 1-1,000 and 1,000-10,000 and 10,000-100,000 and so on is also pretty useless. On a proper scale the entire graph from 1802-1994 would be in the first bracket ($1,000,000), and this would look like an almost flat line along the bottom. Then you would have to go from where the $10 is now to the $10,000,000 in the last two eight-year periods. This would be an enormous spike, hmmm might even look like a hockey stick. Even apart from inflation adjustments, the smooth ever-growing curve shown is grossly misleading.

By Gary Rosen, at Sat Jun 05, 12:58:00 AM:

Anonymous:

Your last post is totally wrong. The chart *should* be logarithmic, which is reflective of year-to-year percentage increases and decreases.

Also, as others have said, it should be adjusted for both inflation (making it go down) and dividends (making it go back up). Again, the most logical way of presenting this is logartihmic showing relative percentage increases/decreases over time.

By Gary Rosen, at Sun Jun 06, 02:07:00 AM:

Another way of looking at stocks is to look at the DJI since the 1929 crash. It has alternated 15-20 year periods of growth and stagnation. By 1949, 20 years after the crash, the DJI still had not surpassed the peak of 1929. From about 1949 to 1966, the Dow grew more or less steadily until it just reached the 1000 mark. It then stagnated until 1982-3, staying more or less flat though with some notable dips e. g. around the time of Watergate. Growth then resumed, strong enough to swiftly overcome the dramatic crash in '87 that now looks only like a larger blip. The DJI plateaued in early 1999, a fact masked by the Internet bubble that took place mostly on NASDAQ. After all the gyrations we are now about where we were in 1999. My prediction based on this past performance is we won't break out of this range until about 2015-6. Now if I could only figure out how to make some money off this!

Dow Jones 1929-2010

Note how this pattern shows up much more clearly in a logarithmic than a linear chart.

By Rick, at Sun Jun 06, 08:19:00 PM:

My parents lived through the 1930's Great Buying Opportunity, but unfortunately their investment funds were limited.

By , at Mon Jun 07, 06:01:00 PM:

@Bombergirl,

Thanks. I'm in the pessimist camp these days. I believe you'll see the S&P 500 fall back to 750, plus or minus 100, which will place the DJIA at 7000, plus or minus 1000. (After today's close at 9816 we're only 1800 points away.) These are nominal dollars. In real, constant dollars this means investing in stocks will have generated a zero return since approximately 1970. This will effectively wipe out all gains of virtually all living investors.

I don't think it is possible to overstate the consequences of this event. When Americans realize that their 401(k) has a net effective return of zero you're going to see the financial equivalent of blood in the streets. Quite justifiably, investors are going to yank money out of risk assets and into safe havens, including mattresses. I think we are witnessing the beginning of a secular change that will last a generation.

I don't use a moniker because registering with registering with any of these services makes you traceable via your IP address.