Sunday, August 09, 2009

Failing to compete in ways that matter

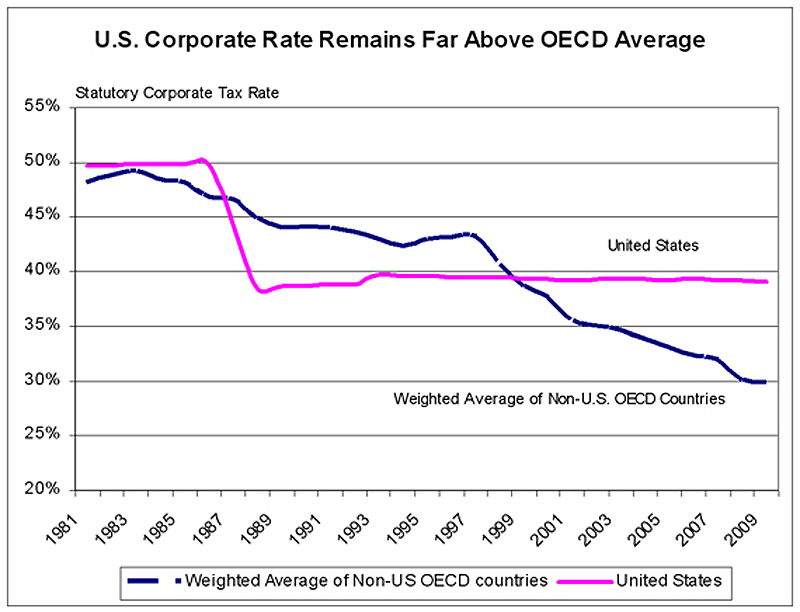

American corporate tax rates have remained the same while other rich countries have been cutting theirs. At the margin, higher taxes cause capital to flow elsewhere, which raises the cost of money, the oxygen that business needs to respirate.

Something has got to give. More through the link.

9 Comments:

By , at Mon Aug 10, 01:22:00 AM:

Hmmm, starting with the Reagan years (1988), through the Clinton years (with the "Clinton" surplus) until the end of Clinton (2000) we had record revenues and "balanced" budgets as long as our tax rate was lower that onter countries.

Coincidence?

By , at Mon Aug 10, 02:11:00 AM:

Coincidence?

I don't think so.

I can see the headlines now, "Under Obama America Leads the Way"

By Neil Sinhababu, at Mon Aug 10, 02:11:00 AM:

Our effective corporate tax rates are actually a good bit lower than that, because we have a whole messload of deductions that other countries don't.

By TigerHawk, at Mon Aug 10, 04:57:00 AM:

Yeah, but as the Tax Foundation study points out, nominal rates have a huge impact on behavior.

And, of course, the main "deduction" is not a deduction at all, but the deferral of domestic corporate tax on foreign income, which President Obama has proposed eliminating. That will bring the effective rate much closer to the statutory one.

By , at Mon Aug 10, 08:06:00 AM:

Good head lines over here well job.........

___________________

christena

Email Marketing Solutions

By , at Mon Aug 10, 10:25:00 AM:

Neil is correct. Effective tax rates in the U.S. are on par or below the rest of the world when one considers deductions and loopholes available to U.S. companies. A quick Google search for the effective tax rate of GE, Microsoft, Intel, or any other major conglomerate will confirm this.

Lower U.S. corporate tax rates are a pipe dream because there are no meaningful constituencies to drive change. Multinational conglomerates actually benefit from the current tax structure. They use "earnings management" to move profits offshore to low-tax jurisdictions. This gives them a competitive advantage over smaller competitors. Stated otherwise, high tax rates and ample deductions allows large companies to game the international tax system as a competitive weapon.

The other major tax lobby is the tax industry itself, composed primarily of accounting firms and law firms. They profit hugely from complex tax structures, and are major contributors on Capitol Hill.

On the other side of the debate are free market think tanks and some small business lobbies. Ever heard of bringing a knife to a gunfight?

I'm a true supply-sider on tax policy. The most efficient tax policy is one with a broad base and a low tax rate. But the political reality is that you can't get there from here.

TH is correct in stating that something has got to give. Something will give--small and medium size business will "give" a lot more in taxes.

By , at Mon Aug 10, 03:30:00 PM:

Neil and Anon may have the right facts but they are answering the wrong question.

At issue is the change in the tax rate with respect to the rest of the world. We may have deductions they don't have, and they probably have ones we don't have, but there is no debate that the change in the comparable tax rates has increased our disadvantage.

By , at Tue Aug 11, 11:21:00 AM:

Tyree,

My comment was directed at the relative meaninglessness of the U.S. Statutory Tax Rate, which is the rate illustrated in the graph. What matters is the effective corporate tax rate, not the statutory corporate tax rate.

The effective corporate tax rate in the U.S. remains competitive with other OECD countries. Here's a somewhat dated and dense CBO study:

http://www.cbo.gov/ftpdocs/69xx/doc6902/11-28-CorporateTax.pdf

Further, it's no secret that investment capital has been flocking to China and India. China has been increasing its effective corporate tax rate by eliminating deductions, and India's tax rate is high than the OECD average.

As I said in my previous post, I'm a supply-side tax advocate. I would love to be able to make the case that excessively high U.S. corporate taxes are driving investment overseas, but I do not believe the empirical data supports that conclusion.

Rather, disinvestment from the U.S., which we recognize as outsourcing and offshoring, is being driven by differences in other business costs, primarily labor and regulatory costs. The average hourly wage of a manufacturing worker in China is approximately $1.00 per hour. An engineer in India earns between $5k-$10k per month. The U.S. could (and probably should) drop the corporate tax rate to zero and we still can't be competitive. Capital will continue to disinvest from the U.S. in favor of Asia.

Since this blog is quasi-political, I'll mention that I do not believe it is a coincidence that the U.S. is on the cusp of implementing a national health insurance program now. For two decades we've been offshoring and outsourcing stable, capital-intensive, middle-class jobs which came with health insurance benefits. These jobs have been replaced with low-wage service jobs that do not provide benefits. Universal health coverage was a major campaign theme of the Democrats, and they now control Washington. Republicans need to wake up on this issue.

By , at Tue Aug 11, 11:26:00 AM:

I need to correct a typo in my previous post. A starting engineer in India earns between $5k and $10 per YEAR, not per month. My bad.