Friday, December 19, 2008

Free money

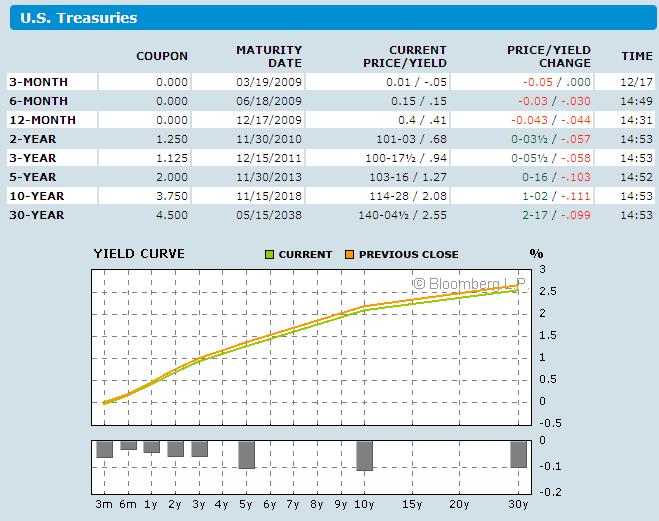

I grabbed this screencap off Bloomberg yesterday afternoon. You are unlikely to see the interest rates on United States Treasury securities this low, or even close to it, again in your lifetime. And I do not care how old you are.

Speaking purely as a taxpayer, I hope the Treasury raises as much 30 year money at these rates as it possibly can.

6 Comments:

By Viking Kaj, at Fri Dec 19, 09:06:00 AM:

Basically government has three things at its disposal to regulate the economy:

1) Cut Interest Rates

2) Spend Money

3) Revise the Tax System

Looks like we are down to options 2 & 3. I expect a massive dose of option 2 courtesy of the Chicago Machine we have presently elected.

Personally, I believe that restructuring the tax system is the most potent weapon at government's disposal to regulate economic behaviour. People will do all kinds of crazy things to avoid paying taxes. Unfortunately we have focussed far too much on income taxes, when we should be looking at consumption based taxes and tax breaks for saving. But then I also believe that the US should have a manufacturing-based economy with a somewhat balanced federal budget, so what do I know?

By Mike, at Fri Dec 19, 09:08:00 AM:

th -

Good luck with that hope. The Treasury is trying to pump money into the economy and inflate the currency, not suck money supply up through bond sales.

By TigerHawk, at Fri Dec 19, 09:22:00 AM:

Well, the Fed. Yeah, it is sort of depressing, isn't it?

By , at Fri Dec 19, 10:03:00 AM:

I came to post the same comment, and yes, it is very depressing. Maybe this is what it takes to get the country off of entitlements- bankruptcy.

By Mike, at Fri Dec 19, 11:50:00 AM:

Thanks for catching my typo on the Fed.

We're about to enter a period of neo-Keynesianism as people forget all the lessons that were painfully proved over the past 70 years.

Throwing some money into bank recapitalization or even the wider economy might make sense in isolation. But we quickly get inured to old-fashioned ideas like fiscal probity. Bailing out GM is just the first of many hare-brained schemes that will pass for common sense before we pull our hand back from the stove again. Get ready for real Change in the domestic economy.

Can't even blame Obama for this.

People like your neighbor Bernanke spent their careers getting ready for this moment and then somehow came unprepared for bad economic news. Of course, a similar effect allowed Paul Krugman's transformation from a respected economist to a New York Times editorialist.

My advice? Stay away from the municipal water supply in Princeton.

By Coach Morgan, at Fri Dec 19, 01:52:00 PM:

Sure wish I'd bought some 30 year bonds in May...would have been the best treasury trade ever.